The cloud vendor selection process has developed an interesting hierarchy: technical teams evaluate capabilities, finance teams analyze costs, but executive committees make final decisions based on analyst rankings. Understanding this dynamic explains why some technically superior solutions struggle while others with strong analyst relationships dominate market share.

In this article, we will dive deep into the reasons behind this trust transfer and its implications for the entire cloud industry.

The Cloud Era: Complexity and Choice Overload

The cloud age has opened up an unprecedented deluge of technology options. Where companies used to have to choose between a few established vendors, now they are presented with thousands of cloud service providers, platform vendors, and solution specialists. While this abundance of choice, for all its benefits to innovation and competition, poses gigantic challenges for decision-makers who have to navigate an increasingly expanding universe of options.

Traditional vendor evaluation methods, such as proof-of-concept exercises and reference calls, are not practical when faced with dozens or hundreds of potential solutions. Organizations do not necessarily have the time and resources to fully test them all in a hands-on manner. This has brought about a need for authoritative, objective sources of vendor information that can help cut the list down to a workable number of candidates.

Analyst firms fill this gap by conducting comprehensive research across entire technology categories, evaluating hundreds of vendors against standardized criteria. Their rankings provide a filtering mechanism that helps organizations identify the most viable options without requiring them to invest enormous resources in preliminary research.

Cloud services have matured far beyond basic storage and compute. Today’s buyers can choose from:

- Infrastructure-as-a-Service (IaaS) providers such as AWS, Microsoft Azure, and Google Cloud.

- Platform-as-a-Service (PaaS)offerings for application development.

- Software-as-a-Service (SaaS) solutions for everything from CRM to supply chain management.

- Specialized providers targeting niches like AI, analytics, IoT, or security.

The multi-cloud and hybrid cloud strategies adopted by many enterprises add further complexity. Organizations are selecting multiple providers, integrating workloads across them, and ensuring interoperability. This web of decisions can be overwhelming without reliable benchmarks.

Analyst rankings distill an immense amount of market research, customer feedback, and performance data into digestible insights, helping teams cut through complexity.

What Analyst Rankings Provide

Vendor selection in the cloud era is heavily influenced by analyst rankings as they provide organizations with trusted, authoritative assessments of cloud providers across a range of critical factors, including technical capabilities, security, compliance, scalability, cost management, and customer support. These analyses help buyers navigate an often confusing and overwhelming cloud services market by synthesizing large volumes of market research, data on capabilities, user reviews, and adoption trends into concise, digestible comparative evaluations. This saves enterprise buyers time and effort in conducting evaluations themselves of multiple alternative cloud services, and also signals to customers that the cloud provider being considered or selected is credible due to extensive third-party validation.

While beneficial for smaller startups, analyst rankings provide significant advantages to larger enterprises, which typically bring more formal procurement processes and high internal expectations and risk aversion to prospective vendor selection. The increased prospect credibility allows for reduced vendor risk perception for both common criteria not evaluating and also for enhanced timeline-matching and confidence when internally justifying the selection of a specific provider by making reference to market leadership validation and/or more widely recognized industry standards.

Despite the extensive, characteristics-driven, user-convertible-weights-based ranking models that analyst firms employ, there are significant non-feature-related aspects they do not incorporate in the end-user process, such as vendor partnership values, vendor implementation, responsiveness, vendor agility, specialization, and customization in catering to specific customer needs. While analyst firm reports certainly serve to elevate and validate a vendor or offering in the minds of end users in their selection, there are always other important aspects that come into play in the actual selection process.

Why Rankings Matter More in the Cloud Era

1. Accelerating Procurement Timelines

Cloud adoption moves at an unprecedented speed compared to traditional IT. Organizations often need to spin up platforms for new projects in weeks, not months. Analyst rankings provide teams with a quick yet comprehensive reference point for shortlisting vendors, eliminating the need to start research from scratch.

2. Minimizing Risk in Strategic Investments

Finding a multi-year, multi-million-dollar cloud vendor may not be risky, but it is important to avoid a poor vendor that doesn’t deliver, isn’t compatible with the corporate ecosystem, or isn’t a good long-term economic partner. Analyst reports lower this risk by mapping the vendor’s capabilities to important use cases and providing peer sentiment data.

3. A Trusted Third-Party Perspective

In a competitive market, every provider claims to be best-in-class. Analyst firms serve as independent authorities, employing a structured methodology. Their impartial view lends credibility and ensures decisions are based on substantiated evidence, not just persuasive sales pitches.

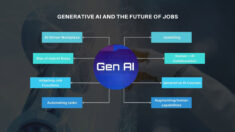

4. Aligning Vendors with Strategic Goals

Modern cloud strategies often involve AI-driven analytics, automation, and multi-cloud orchestration. Analyst reports highlight which providers excel in these emerging areas, allowing IT leaders to match vendors to long-term objectives rather than short-term fixes.