The Australian market began opening its doors to exchange-traded funds in 2001. This move was well-received by many Aussies, spurring its growth and furthering the creation of many kinds of exchange-traded funds in the market. Exchange-traded funds (ETF) come in many forms and can be traded through the use of different strategies. Read on to know more about the choices available and how you can play them to optimise the return of your ETF investment.

The Australian market began opening its doors to exchange-traded funds in 2001. This move was well-received by many Aussies, spurring its growth and furthering the creation of many kinds of exchange-traded funds in the market. Exchange-traded funds (ETF) come in many forms and can be traded through the use of different strategies. Read on to know more about the choices available and how you can play them to optimise the return of your ETF investment.

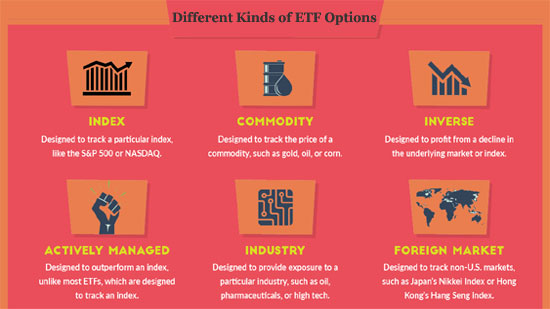

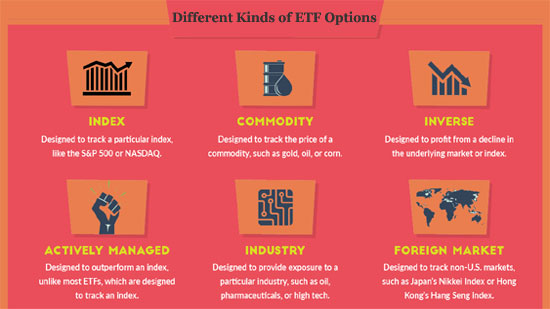

Different kinds of exchange-traded funds

One of the popular kinds of ETFs is stock-based. A stock exchange-traded fund is composed of various indexes having a common feature. If you choose this option, you will be getting a nominal share of each company when you trade them in the ASX.

Similarly, you can also invest in bonds that are centralised on exchange-traded funds. Formerly, regular small-time investors will have difficulty procuring bonds. However, the advent of ETF platforms has allowed regular investors to earn the perk of getting interests associated with their chosen bond.

Exchange-traded funds now also allow even those with small capital to get international bonds. In this way, you do not have to subscribe to an international share trading firm to trade stocks from abroad. However, bear in mind that you have to take into consideration currency exchanges. Your investment will fluctuate as the value of Australian dollars fluctuate.

How to choose

Since there are hundreds of exchange-traded funds available in the market, the best strategy is to look into its underlying indexes. You should at least try to educate yourself about what is in the benchmark so that you will not buy an overvalued exchange-traded fund. One of the ways to do this is by looking at its track indexes. If the index is up by 5%, the exchange-traded fund that you are planning to get should also be up by 5%. You can also use a mobile application like Stash, Fidelity, Fineco Bank, and Plus500 for eft stock updates and reviews.

Active vs. passive trading

Active trading is an aggressive way of playing in the stock market. When you do it well, you can get a very high reward for your trades. This method allows investors to take advantage of the short-term movements through intra-day trading. Profits can be gained even in just a day. As a word of caution, this kind of play also entails high risks. Therefore, if you are just beginning your stock investment journey, you might have to do thorough research first before doing active plays. You might also have to learn strategies such as buying on margins, short selling, sector rotation, and market timing to become profitable in this endeavour.

On the other hand, passive trading is a safer way to engage in the stock market and also best practice to increase credit score. Boost credit 101 can help you to understand it. Investors who do this usually buy an exchange-traded fund and hold it for an indefinite period. Aside from having fewer risks involved, it is also more cost-effective and less time-consuming. However, the only downside to this is that your gain is often just within the index. Nonetheless, it can still be very profitable if you hold your position long enough.

Investing in exchange-traded funds is a worthy endeavour if you want to grow your money. However, while this work does not require physical labour, you have to familiarise yourself with the different kinds of exchange-traded funds in the market. In this way, you will be able to choose which basket you can put your money in so that you can profit optimally.