Settlement planning is an area of law that addresses the needs of individuals who receive large sums from personal injury settlements and other sources. The practice focuses on helping clients manage their funds to meet their post-settlement financial goals while preserving their eligibility for means-tested government benefits like Medicaid and SSI.

For example, a catastrophically injured client might place part of their settlement in a structured settlement to avoid paying income taxes on forgiven debt balances. This strategy can also help the client preserve their eligibility for Medicare.

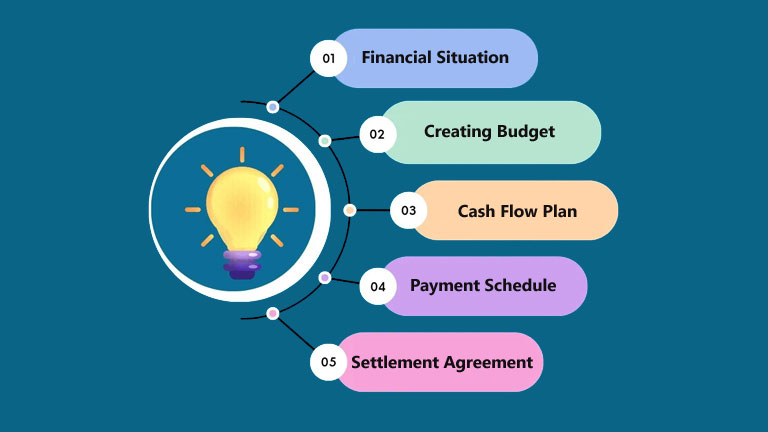

Creating a Budget

To create a budget, start by adding all your income sources including salary (after taxes), savings, and any other regular sources of money, like child or alimony support. Next, add up all your expenses.

You can use bank and credit card statements to help you figure out your costs. Include one-time annual expenses and divide them by 12 to get monthly numbers.

Many states have published initial spending plans for national settlement and other opioid-related funding, identifying priorities or approved uses. Some have even awarded grants directly to specific prevention, treatment, or reduction programs.

Creating a Cash Flow Plan

Creating a cash flow plan requires insight into all business accounts where expenses and incomes are recorded. These are then subtracted from each other monthly, weekly, or daily to get an expected cash balance.

Reviewing this budget from time to time throughout the year is essential, as prices and costs may change. The information needed to do this is often available from your business information systems, such as invoicing or ERP software.

Be sure to account for all important group payments, such as material vendor credit term limits that could significantly change bill payment outflow values. Also, consider including a financing section for capital expenditures like equipment purchases or loan repayments.

Analyzing Your Financial Situation

When a client is about to receive a substantial settlement, it’s important to have a plan to help them meet their financial goals. This is where a settlement planner comes in.

Debt settlement companies are for-profit businesses that offer debt relief programs. They negotiate with your creditors to settle your debt for less than you owe.

While the allure of a quick fix may be tempting, the settlement plan has negative consequences, including a hit to your credit score and tax implications. A better option is to use a debt management plan through a reputable credit counseling agency.

Creating a Cash Flow Report

To make informed decisions about your settlement, you must know how your money is coming in and going out. One of the most important financial reports is the statement of cash flows.

Start by reviewing your business’s sales numbers and overall revenue. You can use these figures to make projections about future revenues and costs.

Then write out a list of all your ongoing expenses rent, salaries, advertisements, software fees, loan repayments, and more. Add other cash inflows or outflows like government grants, tax refunds, lawsuit settlements, or other income.

Creating a Payment Schedule

Many settlement plans include structured annuities, contracts sold by insurance companies that pay a fixed income for life or a specified period. These are an important component of a structured settlement, as they help protect the settlement funds, provide long-term financial security, and can be tailored to meet specific needs and future obligations.

Creditors and debt buyers have different policies for negotiating delinquent accounts, so it’s important to know each one’s practices before approaching them with a settlement offer. Once a payment agreement is reached, it’s critical to get the settlement agreement in writing before sending any money.

Creating a Settlement Agreement

A settlement agreement is a contract that binds parties to adhere to the terms they reach through negotiations. A settlement agreement can be made before or after a claim is filed in court.

Settlement agreements may release a party or parties from future claims. The release must be clearly stated in the document and be signed by the party or parties released. A waiver cannot be obtained from a minor without court approval. It must also be clear whether the release will bar reimbursement claims from Medicaid or Medicare.