For every business, finances are considered to be the lifeline. It is the small businesses that struggle the greatest over it. This is where the role of financial advisors comes into the picture. Over time, a financial advisor’s advice can pay dividends. Financial advisors use their knowledge and experience to help you achieve financial stability. By providing guidance, recommendations, and empowerment. There have been many cases in the past, where financial advisors have helped small businesses seamlessly.

How can Financial Advisors Help Small Businesses:

A strategy for the future’s development:

It’s possible that you, as a business owner, have many goals for your company. You’ll need a long-term strategy in place if you want your business to be successful in the future. Many of these objectives, but, are implausible or impossible to achieve

Having a third-party look at your business plan ensures that you have a clear picture of what lies ahead. With his help, you will see how your business is performing daily. Compares to various performance indicators like market conditions, changing competition, and technological advancements.

Efficient use of resources:

The owners of small businesses wear many hats. Entrepreneurs often have to juggle many roles. Responsibilities across various divisions of their business. When you’re working on a new product, you’re dealing with a customer issue the next thing you know.

With so much going on, you can’t give it all your attention. Finally:

- Poor bookkeeping

- Shaky financial decisions

- Cash flow discrepancies most harm your financial planning.

Delegating your company’s finances to a professional is helpful in this situation. Your financial advisors will keep a close eye on your company’s capital. While you’re busy running the day-to-day operations.

Saving a buck or two

When business owners fail to keep an eye on their company’s finances. They may not be aware of where they’re overspending. A financial advisor will examine your company’s finances and update you on unnecessary costs. You can avoid overspending if you identify unnecessary expenditures. As soon as possible and take corrective action.

Observing and analysing market data

With the best tools available, financial service providers can study market trends, read expert opinions at online and look at the current market statistics. As a result, having an expert’s opinion can help you better understand. How your business performs in competitive markets. They will also use research to help you find solutions to any issues you may be having in the business world.

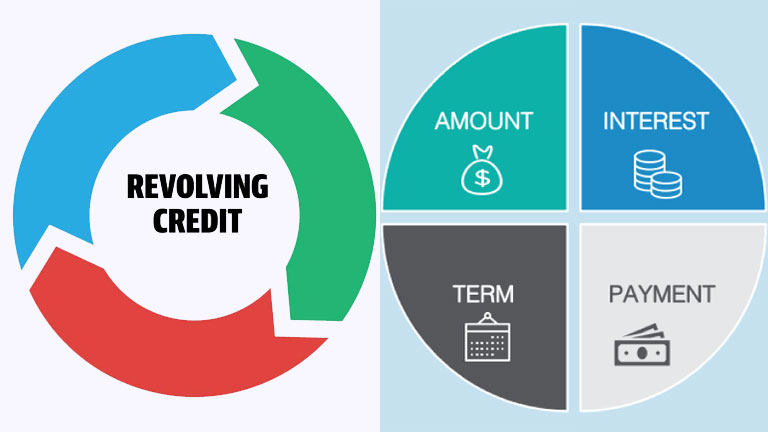

As an example, if your business is short on funds, your financial advisor can better assist you. In determining the type of loan, you should be taking out. They can also help you with any tax issues you may be having.

Investing in Your Future

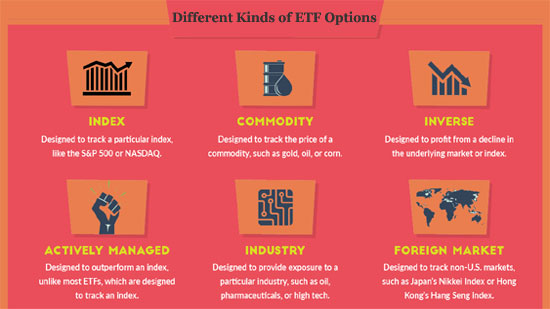

A financial advisor can assist you in determining which investment strategy is best. Suited to your specific needs, such as your anticipated retirement date and method.

Conclusion:

Your business and personal life can enjoy hiring a professional financial advisor. Who can help you avoid several costly blunders and prevent mishaps from taking place?