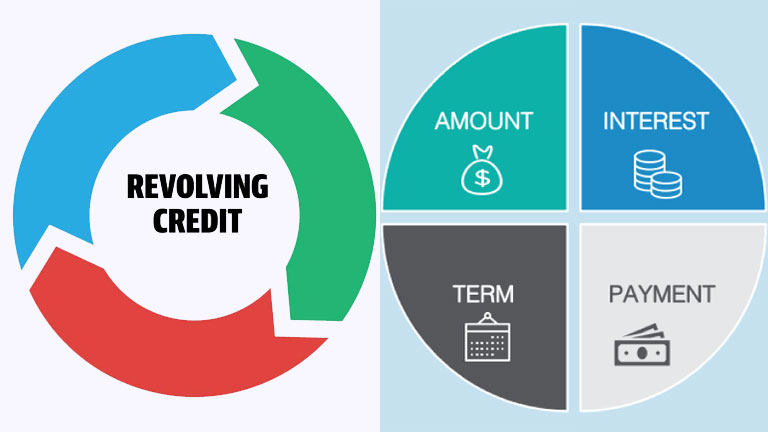

Revolving accounts like credit cards have lower credit limits, and your credit utilization ratio (how close your balance is to the limit) impacts your score. Installment debt, including mortgages and auto loans, has fixed payments and repayment terms, which boosts your credit score.

Versatility

If you don’t exceed your credit limit, you can borrow money as needed and repay it later. Revolving credit is most frequently associated with credit cards, although it is also a feature of personal lines of credit and home equity loans. Revolving debt, including credit card balances, accounts for 30% of your credit score. That’s why keeping your credit utilization ratio at 30% or less is important to maximize your credit score. On the other hand, installment credits like car loans and mortgages can make financial goals easier to achieve by offering predictable monthly payments. To be approved, you must demonstrate your ability to repay an installment loan over time. However, knowing the differences between installment and revolving credit allows you to make wise borrowing decisions that suit your financial situation.

Less Risky

There are many reasons to borrow money throughout a lifetime, such as purchasing a home, going to college, or taking on a home improvement project. Often, you will need more cash to pay for these expenses outright, and credit may be your only option. Regardless of the purpose, installment and revolving credit can make financial goals more achievable for most people, especially when used responsibly with regular, on-time payments. However the two types of debt have very different impacts on your credit, and it’s important to understand what each does to manage your debt wisely. Credit experts say that revolving accounts, like credit cards, impact your credit scores most due to their role in determining your credit utilization. This metric, which is how much credit you use relative to your total available credit, makes up 30% of your score.

Lower Interest Rates

Like those offered by MaxLend, installation credit usually offers lower interest rates than revolving debt. This is because the loan is typically backed by an asset, like your house or car. However, many lenders also look at the overall mix of your credit when deciding on lending decisions. This means that if you have both installment and revolving debt, as long as you make your payments on time, it can improve your credit score. However, it would help if you always kept in mind that your credit utilization, or the percentage of your available credit you’re using, can have a greater impact on your credit score than one open revolving account. This is why it’s important to pay off your balance each month. It will help you avoid paying higher interest rates and avoid financial stress down the road.

Flexible Payments

Installment credit gives borrowers access to more money upfront and often comes with a set payment due each month. This type of credit makes it easier to budget and plan for future expenses and ties borrowers to debt obligations for years.

Both installment and revolving credit can be useful to borrowers looking to build or improve their recognition. Still, it’s important to understand the differences between these types of credit to make informed borrowing decisions. By understanding the pros and cons of each class, borrowers can choose the right credit for their needs and financial goals. Whether buying a home, getting a college degree, or paying off debt, the right credit can help you achieve your financial goals.